State Again Taxes And The Statute Of Limitations

Table of Content

The IRS typically doesn't know which tax deductions or tax credit you might need qualified for, resulting in a invoice greater than what you might've had when you'd carried out it your self. If you live in one of many other 41 states, you’ll have to file a state tax return along with your federal tax return. The IRS website contains a directory that will assist you find data on your state’s tax necessities.

However, you could wait up to eight weeks should you file in April, which is usually when states receive the overwhelming majority of returns. Maine allows taxpayers to verify their refund status on the Refund Status Information page. The site says that info is up to date Tuesday and Friday nights, and adjustments are updated the following day. You will need to enter your SSN, submitting standing and the exact amount of your refund.

Relax—run Payroll In Simply Three Simple Steps!

Harvest tax losses.You can turn misplaced worth on investments into a decrease tax bill by way of a process known as tax-loss harvesting. With this technique, you can sell investments, similar to mutual funds, that have misplaced value over the year and buy considerably similar investments to exchange them. You end up realizing a loss for tax purposes, however your investment might in reality gain worth relying on how the alternative fund performs over the year. Tax-loss harvesting allows you to report losses to offset the funding gains you might owe taxes on, resulting in a decrease funding revenue tax legal responsibility. BackTaxesHelp.com is doubtless certainly one of the premier tax decision websites serving Oklahoma, offering tax solutions for every individual’s distinctive financial situation.

Refunds can take 9 to 10 weeks to course of from the date that your tax return is received. If you elect to obtain your refund as a paper check, you'll find a way to expect it to take an additional two weeks. If you e-filed and have not heard something about your refund within 10 weeks, name the state’s Department of Taxation.

Finest (top Tax Reduction Companies You Can Belief

The return we put together for you'll lead to a tax invoice, which, if unpaid, will set off the gathering process. This can include such actions as a levy in your wages or checking account or the filing of a notice of federal tax lien. NerdWallet strives to keep its information accurate and up to date. This info could also be totally different than what you see if you go to a financial establishment, service supplier or specific product’s website. All financial products, buying products and services are introduced without warranty. When evaluating presents, please evaluate the financial institution’s Terms and Conditions.

Partners can not pay us to ensure favorable editorial evaluations or ratings. We don't publish favorable editorial evaluations or assessments at the course of an advertiser or partner. We all the time work to put customers first and do our greatest to offer value in meaningful ways, but our evaluations are subjective. An individual's state taxing authority will offer either a progressive tax rate just like the IRS or a flat tax fee.

At Lifeback Tax, we serve all 50 U.S. states and our staff has extensive expertise in settling each state and federal tax debts! We are qualified to characterize taxpayers for circumstances involving revenue tax, sales tax and withholding tax. Although it's possible to resolve your state back taxes independently, your probabilities of achieving an optimal settlement will improve as quickly as you retain the services of a qualified tax professional.

For instance, the gross sales and use tax rates in California differ by county. Student mortgage offers that appear on this web site are from companies or affiliates from which solvable might obtain compensation. This compensation could influence how and where products appear on this site (including for instance, the order during which they seem or whether or not a lender is “featured” on the site).

The knowledge you gain about taxes will allow you to have a more complete understanding of them and will let you make assured selections primarily based on that data. That earlier success units the stage for the coalition’s present push to be a measure of Hochul’s budget this time around, her first after being elected governor. It takes approximately 6 weeks for us to process an precisely accomplished overdue tax return. When LLCs are taxed as a corporation, they are subject to double-taxation, too. In the case of LLCs taxed as a company, the LLC can include the business earnings tax in the EBITDA calculation. For instance, you have to pay payroll taxes in case you have workers.

If you filed a paper return, you can expect to wait as a lot as eight weeks. Allow an additional three weeks if you sent a paper return sent through certified mail. Checking on a tax refund is easy for Pennsylvania taxpayers. You can expect a refund to take eight to 10 weeks for processing. New Jersey’s Division of Taxation permits taxpayers to examine the standing of refunds by way of its Online Refund Status Service.

Solvable doesn't embrace all student loan corporations or all types of offers obtainable within the market. Here at Solvable, we attempt to offer you companies to help you gain a greater understanding of how taxes work. Not solely will we assist you to get a grasp on what taxes are, but provide an unparalleled method for connecting you with tax professionals.

There is no hard-and-fast rule but you'll be able to expect paper returns taking considerably longer to process than e-filed returns. In the meantime, you'll be able to work with a financial advisor to create a plan for the cash you anticipate to obtain. Several states enable computerized extensions of time to file your private income tax return provided that you first get hold of an extension to file your federal tax return.

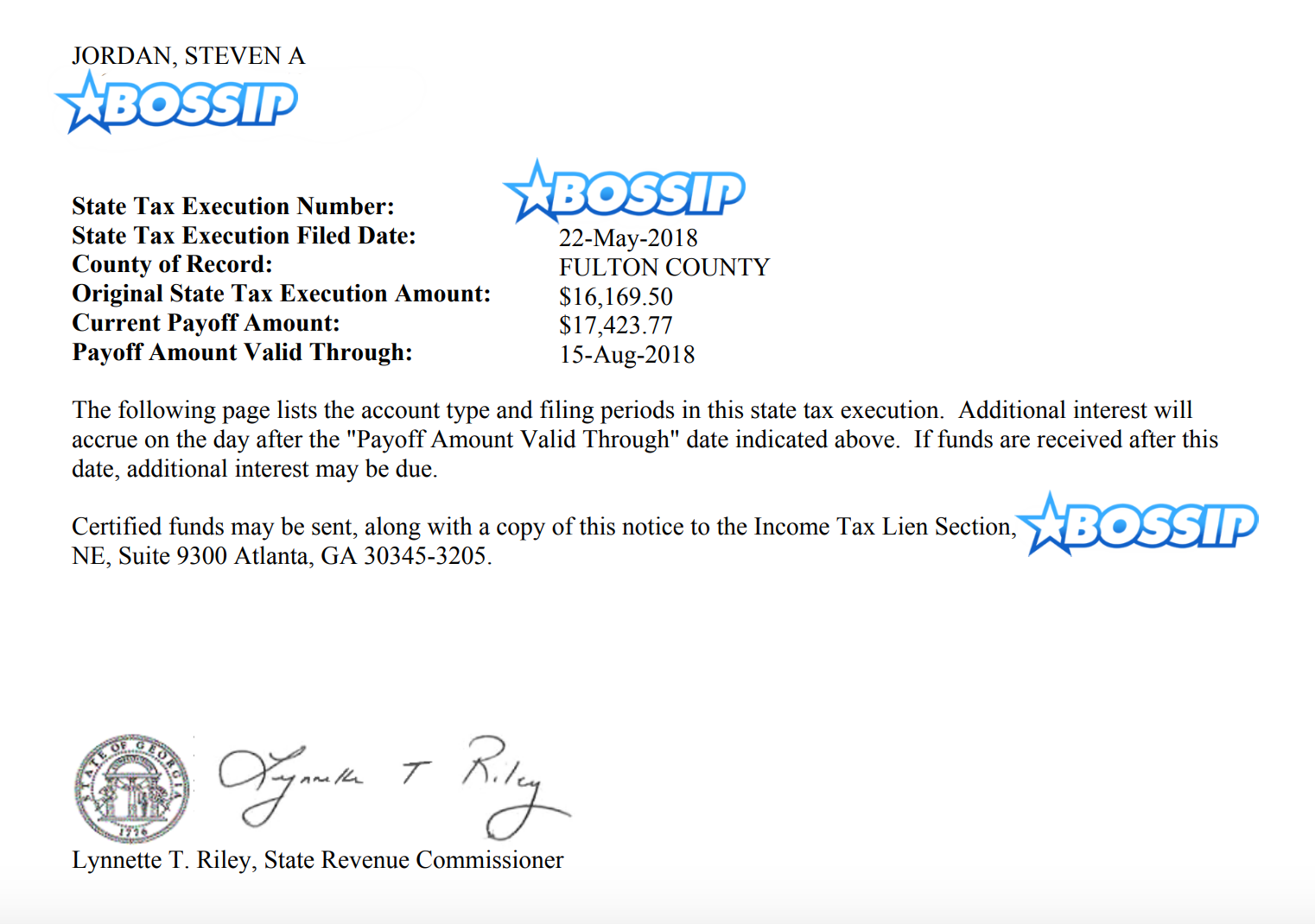

Generally, most states will finally file a tax lien against taxpayers who have didn't file their tax return or failed pay the tax debt owed. However, every state has its own tax codes and legal guidelines for assortment procedures. In order to determine the state-specific consequences for unpaid again taxes, contact your local tax authorities. Some are totally or partially refundable, which means that if their value is greater than the filer’s income tax liability, the filer is paid the excess. So, married taxpayers who filed jointly will obtain one rebate.

Beginning in January 2023, taxpayers will be capable of prepare and eFile 2022 IRS and state revenue taxes. For all earlier years or back taxes, discover the tax varieties in your eFile account and beneath as properly. You can complete and signal the types earlier than you obtain and mail them to the IRS mailing address or state tax company - state mailing addresses are listed on particular person state pages. Be sure to make use of the previous year mailing tackle and never the current mailing tackle so your return goes to the best place. See how to file a 2020 and 2021 Return to assert a missing stimulus cost plus particulars on the Recovery Rebate Credit.

Comments

Post a Comment